Getting My Financing Bad Credit To Work

Debtors with bad credit score may receive reduced rates of interest considering that they're installing security. If you fail on a protected finance, your lender may legally take your security to recover the cash - financing bad credit. And if your lender doesn't recover the expense of the funding by retrieving your properties, you may be accountable for the distinction.

Payday advance are considered a much more uncertain sort of finance, with astoundingly high charges and also rate of interest. These fundings are normally much less than $500 and also are anticipated to be repaid within 2 to 4 weeks. Many individuals that obtain payday advance loan often have to obtain added lendings to repay the initial cash advance, trapping them in a cycle of debt.

Everything about Financing Bad Credit

Consumers that have good backgrounds with their financial institution. If you want a short-term solution, you can use an already beneficial relationship for economic support. This option might not be supplied at all financial institutions. If you have bad credit scores, you may have the ability to profit the equity you've constructed into your home using a house equity car loan.

Like individual fundings, with a home equity loan, you'll be offered the cash in a swelling amount. Those that require large sums of money and also have equity in their residence Enables consumers to secure approximately 80% of their residence's value. Due to the fact that you're utilizing your home as collateral, defaulting on your residence equity lending might result in shedding your home.

Unlike residence equity loans, HELOCs normally have variable rates of interest (financing bad credit). Borrowers who aren't certain just how much cash they require and desire to be able to borrow from their house's equity over a period of time Consumers can borrow and also repay as required, and recycle the line of credit score. Since rates of interest vary, consumers might experience extremely month-to-month settlements.

Some Of Financing Bad Credit

While lots of loan providers do not allow customers to make use of an individual financing towards education financing, loan providers like Upstart do enable it. Those who are going after funding for academic objectives Some student car loan lenders will certainly hide to the entire cost of your tuition. Some lending institutions have stringent or vague forbearance and also deferment programs or none at all in instance you're unable to settle the lending down the roadway.

Represent all personal revenue, consisting of income, part-time pay, retirement, investments and also rental residential or commercial properties. You do not require to consist of spousal support, child assistance, or different upkeep earnings unless you want it to have it taken into consideration as a basis for repaying a lending. Increase non-taxable income or advantages included by 25%.

The offers for economic products you see on our system originated from business that pay us. The money we make aids us offer you accessibility to free credit report and reports as well as aids us produce our other terrific tools and instructional materials. Settlement might factor into how and also where items appear on our system (and in what order).

What Does Financing Bad Credit Mean?

That's why we give functions like your Authorization Chances and also cost savings quotes. Of program, the deals on our system do not stand for all financial items out there, yet our objective is to show you as lots of great choices as look at these guys we can.

Additionally keep in mind that these fundings are not necessarily readily available in all states. Auto-secured loans from One, Main Financial generally have lower passion prices than the business's unsafe car loans. However they include prices, including source, late as well as inadequate funds charges that might increase the amount you have to pay off.

99 to get a credit-builder funding, but you can make incentives to balance out the fee. With most credit-builder car loans, you have to wait until you make all your repayments to obtain your money. With Money, Lion, you get a portion of your funding continues ahead of time, as well as the business puts the remainder in a credit get account that you can access at the end of your finance term.

The Best Guide To Financing Bad Credit

Earnin is an app that gives passion- and fee-free cash advances of as much as $750, using your next paycheck as collateral. Utilizing Earnin doesn't affect your credit score, yet to make use of the application you need a stable paycheck, straight down payment into a monitoring account and also a dealt with work location. If approved, you may have the ability to get your cash on the very same day.

What Does Financing Bad Credit Do?

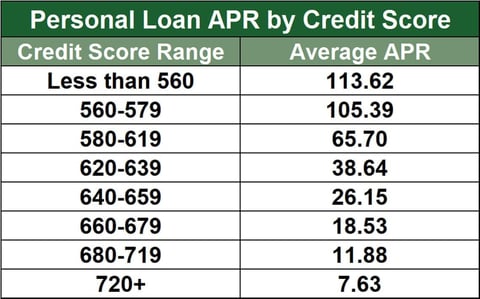

Whether you desire to best site settle high-interest financial debt, fund a residence renovation or take treatment of an emergency situation price, an individual finance might aid. Right here are some things to understand if you're taking into consideration applying for an individual funding with negative credit. If you have negative debt, an individual financing might cost you much more because lenders may see you as a greater credit score danger.

Right here are a couple of fundamental terms to take note of. APR is the complete cost you pay annually to obtain the money, consisting of interest and also certain costs. A reduced APR indicates the car loan will generally cost you much less. An individual financing go to this web-site for someone with negative credit score will likely have a higher APR.

A lot of personal loans need you to make fixed month-to-month payments for a set amount of time. The longer the settlement period, the more interest you'll likely pay, and the more the loan is most likely to cost you. Monthly settlements are mostly established by the amount you borrow, your rate of interest and your finance term.

The Bbb knows regarding many lending institutions, and you can check the consumer issue data source kept by the Consumer Financial Protection Bureau to locate out if people have actually submitted grievances versus a loan provider you're thinking about. While receiving a personal car loan can be challenging and also costly for a person with negative credit rating, loaning might make good sense in certain scenarios.

Comments on “Financing Bad Credit Things To Know Before You Get This”